Starting a campsite business in the UK presents common (and ‘not so’ common) choices of business model. It’s worth weighing up the merits of each mode of starting up before taking the plunge. [Read more…] about Top 4 Ways To Start A Campsite Business In The UK (Pros & Cons)

Quiz: Plan Campsite Profits

#4 Campsite Business Case Study: Campsite Expansion

Background

You have a master plan of expanding your campsite from 30 pitches to 90 pitches.

In other words, you want to add another 60 grass pitches.

This will take your total number of serviced pitches to 25 (unserviced pitches therefore 65).

The council will permit up to 120 so there are no regulatory restrictions.

However, you do understand that you’ll need to extend your current toilet and bathroom facilities, which will cost you £25,000.

Problem

“I really hope this expansion project will pay off within 3 years. If not, I’ll rethink it. But how do I make a clear judgement on that?”

“Also, I’ll need to up my marketing. What traffic level should I get my website up to for attracting the extra business needed?)

“How is it most realistic and profitable to increase my website traffic sufficiently?”

Research

You find the following inputs which you’ll use for your plan:

- Your current website bookings conversion rate is 2%.

- Inflation is expected to average 9% between 2023 – 2026.

- Interest on a loan for extending toilet facilities is 7%.

- Average monthly occupancy:

- Mar 30%

- Apr 40%

- May 55%

- June 50%

- July 60%

- Aug 70%

- Sept 38%

- Oct 30%

- 244 total nights of trade in the season

- 30 pitches: 65 standard at £19.00 per night / 25 premium pitches at £25.00 per night

- Net operating income percentage: 37%

Solution

Firstly, the calculation to estimate your campsite income after expansion:

Use the Campsite Financial Analyser to calculate the solution to the problem above.

Using a net operating income percentage of 37%, you now calculate your annual operating expenses for the expanded campsite operation:

Use the Campsite Financial Analyser to calculate the solution to the problem above.

= £ 142,523.74

Now, calculate the total loan repayment for extending the toilet facilities including the interest (cost of loan):

(Source: Money Supermarket)

The total amount repayable will be £27,7000.99 (interest charge on £25,000 at 7% over 3 years).

Now, use the figures above to complete a Benefit Cost Analysis of your new campsite expansion project:

(Source: Project-Management.info)

The Benefit Cost Analysis resulted in a ratio over 1 (1.3861). This indicates a profitable venture.

And now, you reverse engineer your 2% website conversion rate to work out the necessary web traffic required to book another 60 pitches per month:

60 / 0.02

= 30,000 more targeted web visitors per month

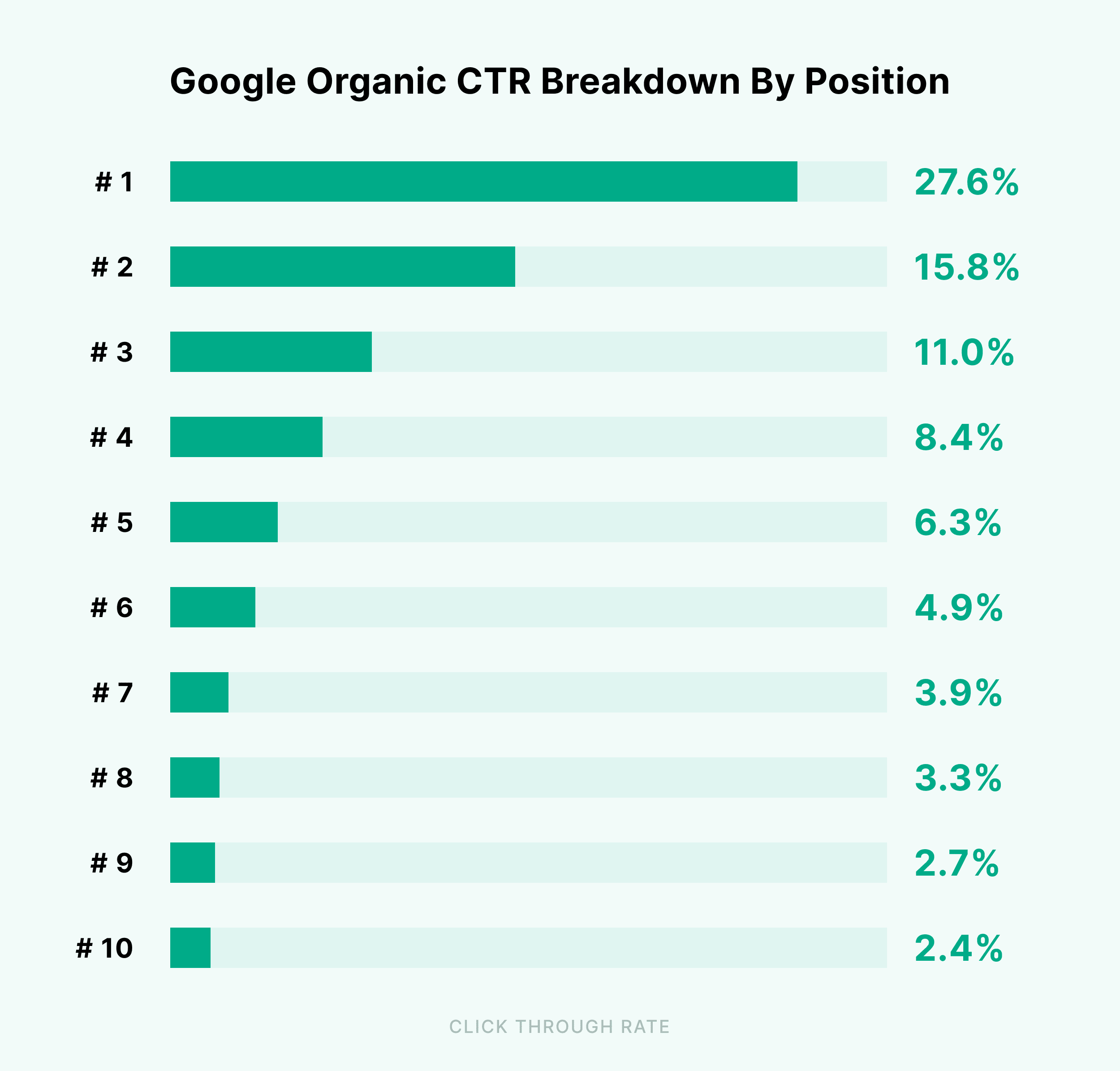

Achieving an average position within the top 3 rankings on the 1st page Google for your selected keywords would attract roughly 18.13%, going by this research study:

(27.6% + 15.8% + 11%) / 3

= 18.13%

Therefore, 30,000 / 0.18 would be the overall traffic volume offered by new chosen keywords:

166,666 or rounded up to 170k visits per month.

Remembering that large exposure online could also be achieved through well targeted PR articles in national, regional and local press.

But this calculation above is a rough way to work out how much targeted web traffic you’d need to generate the demand to satisfy your ambition for growth.

Whilst discovering keywords grossing 170k might sound like a tall order – you can drastically broaden your search horizons online through content marketing.

In other words, adding value on related searches that your target audience might also type in relating to their journey.

Go To Part 18: https://campsitebusinessplan.co.uk/knowledge-base/quiz-plan-campsite-profits

#3 Campsite Case Study: Buying A Campsite

Background

You’re in the market for a campsite business as a going concern.

There’s one that’s taken your eye:

Coastal 120 Pitch Campsite And Letting Cottages For Sale

St. Mary’s, Isles of Scilly, UK

Asking Price:

£1,025,000

Turnover:

£265,000

Net Profit:

£125,000

-

- Campsite (with 10 electric hook ups)

- Set within c. 6.87 acres of mature grounds

- Permission for 120 camping

- Letting cottages and 5 bed owners

- Remainder of long lease

- Rare opportunity with ebitda of c. £125k

You’ve got the budget for buying at their asking price, but you want to make sure that the price is fair.

Problem

“I’d like to buy this campsite, but what is a fair asking price?”

Research

You estimate it to take 8 years for the campsite to pay you back for funding the investment.

You capitalisation rate is therefore 8%.

A standard valuation method would either have you:

[A] divide the expected net operating income of the campsite by this capitalisation rate to arrive at a reasonable market value,

OR

[B] multiply the gross annual revenue by 2.8 to get the sale value.

Solution

£265,000 x 2.8

= £742,000

or

£125,000 / 0.08

= £1,562,500

BONUS QUESTION:

“But…what size campsite would generate £265,000 gross revenue (in terms of number of pitches)?”

SOLUTION:

This advert claims the the campsite has 10 electrical hookups (the remainder being standard pitches presumably).

The site also has permission to operate 120 pitches. so, room for expansion.

First, of all just the 10 electric serviced pitches are likely to produce:

Taken away from the gross annual revenue of £265,000 leaves…

…£239,264.71 to be earned elsewhere within the business model.

The mention of 4 holiday rental cottages made you assume a price of £80.00 per night, each. Again, with the same occupancy rate as the camping pitches.

Now, this makes the annual revenue figure:

Taking this figure away from the annual gross revenue of £265,000 leaves…

£195,030.97

Now, assuming the remaining income is from unserviced grass pitch customers…this is how big a site you’d need to satisfy the revenue figure:

The answer: 93 standard grass pitches.

And here’s the proof…

Use the Campsite Financial Analyser to calculate the solution to the problem above.

Go To Part 17: https://campsitebusinessplan.co.uk/knowledge-base/4-campsite-business-case-study

#2 CAMPSITE BUSINESS CASE STUDY: SCENARIO PLANNING

Background

You have in mind to go ahead and set up a 30 pitch campsite on a spare 2 acres you have on your smallholding.

However, you’re in two minds as whether to open up for 8 months or 6 months.

You and family reckon you could probably do with getting away in late August for a break instead of November.

Problem

“I need this campsite to make at least £23,000 net operating profit to meet my target salary. Will I still make that if I close in early September instead of end of October?”

Research

You find the following inputs which you’ll use for your plan:

- Average pitch price per night £22.00

- Average monthly occupancy:

- Mar 30%

- Apr 40%

- May 55%

- June 50%

- July 60%

- Aug 70%

- 184 total nights of trade in the season

- 30 pitches: 15 standard at £19.00 per night / 15 premium pitches at £25.00 per night

- Net operating income percentage: 37%

Solution

Use the Campsite Financial Analyser to calculate the solution to the problem above.

Go To Part 16: https://campsitebusinessplan.co.uk/knowledge-base/3-campsite-business-case-study

#1 Campsite Business Case Study: Profit Calculation

Background

You have a couple of acres of land unused on your farm and you’re thinking of setting up a campsite.

A plan is emerging and you have in mind to install a mixed economy of pitch types. Perhaps 30 pitches.

A season of 8 months is what you have in mind.

The exercise is simple:

Problem

“How much net operating income will I make from a 30 pitch campsite?”

Research

You find the following inputs which you’ll use for your plan:

- Average pitch price per night £22.00

- Average monthly occupancy:

- Mar 30%

- Apr 40%

- May 55%

- June 50%

- July 60%

- Aug 70%

- Sept 38%

- Oct 30%

- 244 total nights of trade in the season

- 30 pitches: 15 standard at £19.00 per night / 15 premium pitches at £25.00 per night

- Net operating income percentage: 37%

Solution

Use the Campsite Financial Analyser to calculate the solution to the problem above.

Go To Part 15: https://campsitebusinessplan.co.uk/knowledge-base/2-campsite-business-case-study